Free Marketplace where Lenders Compete

Get Pre-Approved for up to $500,000

![]()

Funded by our network in 2017

What do we Lease?

You name it, we finance it!

-

Medical Equipment Financing & Leasing

MRI, CT, Ultrasound, Digital X-ray, Dental Equipment

-

Franchise Financing & Leasing

-

Restaurant Equipment Leasing

Dishwashers, Commercial Ovens, Refrigeration, Bakery Equipment, Commercial Fryers, Ice Machines, Point of Sale Systems

-

Office & Telecom Technology

Copiers, Labeling Machines, Telephone Systems, Servers, Routers, Video Conferencing, Furniture, File Systems

-

Manufacturing Leasing

Conveyor, Machine Tools, Robotics, Welding, Generators, Assembly Systems, Automation

-

Technology

Security Systems, Servers, Networking, Plotters, Software, Access Control Systems, Computers & Workstations

We say YES more!

Our financing platform is powered by FinanceApp Score, which is a better representation of your businesses overall health. Your FinanceApp score combines your credit score along with the industry and the equipment you are looking to lease. We then work with more than one lender in order to negotiate the lowest monthly payment.

- Opening New Medical Practice

- 610 Credit Score

- Licenced Doctor

- Start-up Business

Save thousands on your taxes by leasing!

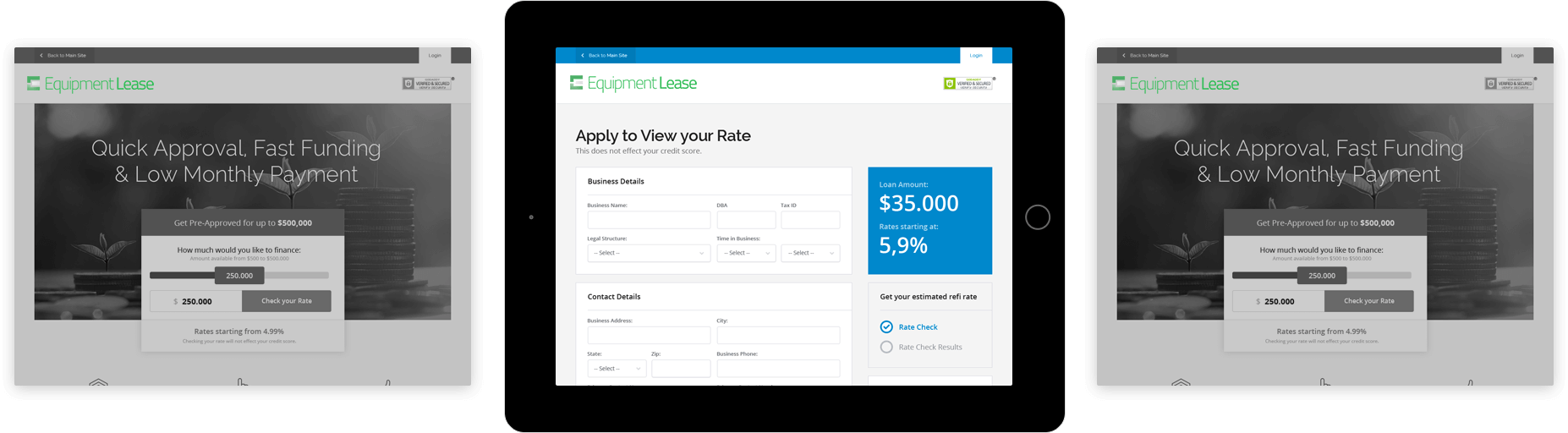

Easy, Fast, Application

web & mobile at the same time

There's no easier way to apply for financing. Our application can be accessed anywhere, anytime on any device. Our 3-Step application will provide you with an immediate quote.

Pick the payment that best works for you

- No Money

Down - 5.5% Interest

$500/month - 90 Days

No Payments

There's no easier way to apply for financing.

Our applicatiion can be accessed anywhere, anytime on any device. Our 3-Step application will provide you with an immediate quote.

Tax Benefits + Leasing = Huge Savings!

What are the advantages to leasing?

There are many aspects to leasing, we list out the best reasons here

-

NEVER BE OBSOLETE

Technology and equipment are always advancing. When you lease, you have the advantage of keeping your equipment up to date. The financial burden of the obsolete equipment is passed onto the leasing company. If your lease term is 2 years, this means that you are free to lease whatever equipment you want after the lease expires.

This mean that you can always have the newest, faster and most technologically advanced system. This can give you a significant advantage against your competitors and help you grow your business.

-

TAX ADVANTAGES

There is no better reason to lease than the tax benefits. When you lease equipment, the IRS allows you to deduct the lease payment as a business expense. With the Section 179 deduction, you could also qualify to deduct the full amount of the equipment even if you do not pay the full amount in the current year.

Click here to learn more about Section 179 and check out our Section 179 Tax Calculator to better understand how much you can save.

-

NO DOWN PAYMENT

One of the best reason to lease is it requires no money out of pocket. This will free up your cash flow and allow you to purchase the equipment you need to grow your business. Banks and traditional lending institutions tend to want a deposit or some money up front to finance the remaining part of the loan.

With EquipmentLease.com, you only need to fill out one application and be done. It is that easy!

-

FIXED MONTHLY PAYMENT

When purchasing equipment for your business, you want a fixed cost so you know what your monthly break-even is. Some loans start off with a low monthly payment or interest rate, but then increase as the market changes.

With EquipmentLease.com, we lock your low monthly payment in for the entire term of your loan. Keep in mind, we do have programs that we can offer a step payment for start-ups or businesses that might need more time to cover the monthly expense.

Call Us Toll Free

Call Us Toll Free  Live Chat 24/7

Live Chat 24/7